“Create a Will!”, is something that might or might not have popped up in your mind. While Canadian politeness extends to many aspects of life, one area that requires assertive action is estate planning of which a well-written Will is a key component, it is a critical step in ensuring your wishes are carried out after you pass away. In Canada, a staggering number of individuals – over half, in fact – die intestate (without a will). This can lead to a lengthy and expensive probate process, placing a significant burden on loved ones during an already difficult time.

What’s a ‘probate process’? Very simply put, this is the legal system sorting through your belongings after you pass away. It’s the court’s way of making sure everything is handled fairly and according to the law. When you have a Will, your wishes are clear.

Dying Without a Will: The Consequences

Dying without a will in Canada, known as dying intestate, means that provincial laws will decide how to distribute your estate and appoint your executor. Your estate includes all your assets (anything of financial or other value) and any debts. The distribution of your estate varies by province, and it may not align with your personal wishes since the government doesn’t consider individual family needs.

If you do not create a will before you die, some of your assets will be transferred into your estate, while others may go directly to a named beneficiary if you have one. For instance, if you have a named beneficiary on a life insurance policy, they will receive the death benefit directly, bypassing your estate. This means you won’t need to pay probate taxes on the insurance proceeds, and your beneficiary may receive the funds faster.

Without a will, provincial legislation will determine who receives your estate. This could include assets such as:

- Your home, if not jointly owned

- Your business

- Bank accounts

- Family heirlooms

- Insurance proceeds, investment accounts, and retirement savings (if no direct beneficiary is named)

- Collectibles, such as artwork, vehicles, and jewelry

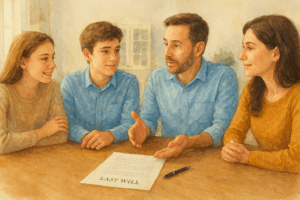

While what you read above may sound not only complex but also unlikely, it only takes one twist of fate to make it all too real. Imagine Bob, an engineer in Ontario, who lives a busy life with his wife and three kids. Focused on his career, he never got around to writing his Will even though he fully planned to do so in the near future. He knew the importance of a will, he just did not have the time in the face of many more urgent things to do. One day, Bob passed away unexpectedly. His wife, Jane, found herself entangled in the probate process which required the court to appoint an administrator for Bob’s estate. This delayed access to Bob’s assets that he owned individually (without having Jane as a co-owner). On top of the grief, Jane had to figure out the legal process and work with a lawyer (which was expensive) to resolve the issues.

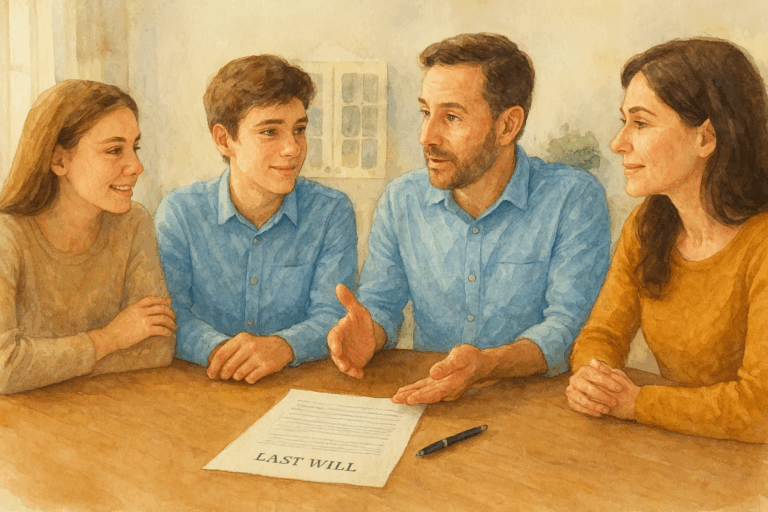

Dying without a will means you have no control over how your assets are distributed, which may not reflect your wishes. This can result in increased costs and time required to divide your assets, significantly impacting your loved ones. Having a legal will ensures your estate is handled according to your wishes, providing peace of mind for you and your family.

Create a Will to ensure your legacy

Wills are critical for ensuring your legacy, but the process doesn’t have to be complicated. Willezy offers a comprehensive and user-friendly platform to help you create a legally valid will from the comfort of your home. Willezy empowers you to take control of your future and provide peace of mind for your loved ones. Create a Will today.