What is Probate?

Probate is a legal process in that grants the estate trustee the authority to manage and distribute a deceased person’s estate. This procedure involves validating a will, confirming the appointment of an estate trustee, or authorizing someone to manage an estate without a will. While not all estates require probate, it is often necessary when significant assets, disputes, or real property are involved.

When is Probate Required?

Probate in Ontatio is necessary in the following scenarios:

- The deceased person died without a Will

- The deceased’s will does not name an estate trustee

- A financial institution wants proof of a person’s legal authority to receive the money or investments of the deceased

- The estate’s assets include real property which does not pass to another person by right of survivorship

- The deceased’s real property must be sold (a Certificate of Appointment of Estate Trustee or a Small Estate Certificate should be obtained before anyone enters into an Agreement of Purchase and Sale)

- There is a dispute about who should be the estate trustee

- There is a dispute or potential dispute about the validity of the Will

- Some beneficiaries named in the will are not able to provide legal consent

Assets Included in the Probate Process

The following assets are subject to probate and included in the estate’s value for calculating Probate Fees i.e. Estate Administration Tax (EAT) in Ontario:

- Bank Accounts: Accounts solely in the deceased’s name

- Real Estate: Properties located in Ontario, except for jointly held properties that transfer automatically to the surviving owner

- Investments: Stocks, bonds, mutual funds, and other investment accounts solely in the deceased’s name

- Vehicles: Cars, boats, and other registered vehicles

- Personal Property: Jewelry, art, furniture, and other valuable possessions

Assets Excluded from Probate

Certain assets bypass the probate process and are not included in the estate’s value for EAT purposes:

- Jointly Held Assets with Right of Survivorship: These assets automatically pass to the surviving owner, including real estate or joint bank accounts

- Life Insurance Policies with Named Beneficiaries: Proceeds go directly to the designated beneficiary

- Registered Accounts with Beneficiaries: RRSPs, RRIFs, and TFSAs with valid beneficiary designations

- Pension Plan Benefits: If a beneficiary is named, these are excluded from probate

- Trust Assets: Property held in a trust does not form part of the estate and avoids probate

Types of Probate Certificates in Ontario

The court may issue two main types of certificates based on the estate’s value:

- Certificate of Appointment of Estate Trustee:

- Required for estates exceeding $150,000

- Grants the trustee authority to manage and distribute the estate

- Small Estate Certificate:

- For estates valued at $150,000 or less

- Offers a simplified application process

A probate certificate:

- Confirms the court’s recognition of the executor or estate trustee’s authority

- Is required by banks, insurance companies, and other institutions to release funds or transfer titles

- Ensures that all estate matters align with Ontario’s legal requirements

- Establishes clarity and authority, reducing conflicts among beneficiaries or creditors

Steps to Apply for Probate in Ontario

- Determine Asset Value: Calculate the fair market value of real estate, bank accounts, investments, vehicles, and personal property

- Prepare Documentation: Include the deceased’s will, proof of death, and court forms like Form 74A and supporting affidavits

- Pay the Estate Administration Tax (EAT): The tax is based on the estate’s value (see calculator below)

- Serve Notices: Inform beneficiaries and other parties with a financial interest in the estate.

- File Documents with the Superior Court of Justice: Submit all forms and tax payments to the appropriate court location

💡 Important: File the Estate Information Return within 180 days of receiving the estate certificate.

How Estate Administration Tax (EAT) is Calculated

As of January 1, 2020:

- No tax is charged on estates valued at $50,000 or less

- For estates over $50,000, the tax is $15 per $1,000 of the estate value exceeding $50,000

Example Calculation:

For an estate worth $200,000:

- Tax on the first $50,000 = $0

- Tax on the remaining $150,000 = $150 x $15 = $2,250

- Totak Probate Fees = $2,250

Ontario Probate Fee Calculator

Ways to avoid Probate

Probate in Ontario can be a lengthy and costly process. By planing ahead, there are various ways to reduce or even avoid probate altogether, preserving your estate for your loved ones while minimizing fees; below are few of the strategies:

- Set Up Joint Ownership for Real Estate or Bank Accounts

One of the simplest ways to avoid probate is through joint ownership. By placing your property, bank accounts, or other valuable assets in joint ownership, you can ensure they automatically pass to the surviving owner upon death. - Simplify the Estate

One of the most straightforward ways to avoid probate is to simplify your estate before your death. This can be achieved by gifting assets such as property, vehicles, investments, and cash to family members while you’re still alive. When you give assets away, they are no longer considered part of your estate, which can significantly reduce the estate’s value, helping you avoid probate fees, however:- Consider the tax implications: Gifts may trigger capital gains tax or other tax consequences depending on the asset type

- Loss of control: Once assets are gifted, you no longer control or manage them. While gifting early has its benefits, it’s important to weigh the emotional and financial impact on your beneficiaries and consider how it aligns with your overall estate plan

- Name Beneficiaries Directly

Naming beneficiaries for your assets is a powerful tool to avoid probate. When a beneficiary is designated, the funds or assets are transferred directly to them upon your death, without going through probate. You can name the beneficies for the followiing assets:- Life insurance policies

- Pension plans, and

- Registered savings accounts (like TFSAs and RRSPs)

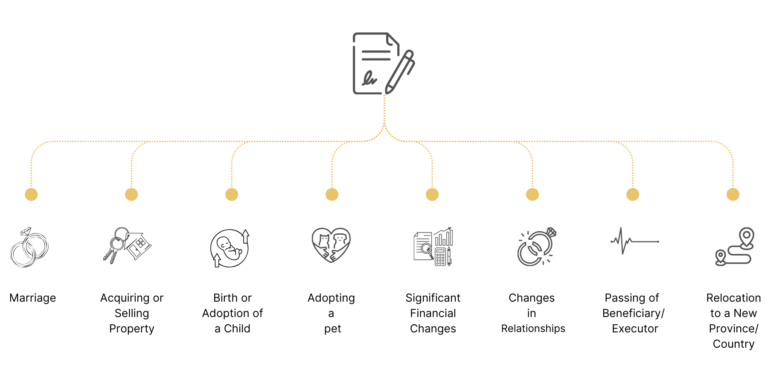

- Make a Will

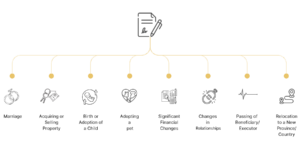

While creating a Will doesn’t eliminate the need for probate, it can help clarify your intentions and simplify the probate process. A valid Will ensures that your assets are distributed according to your wishes, minimizing disputes among beneficiaries. Moreover, appointing an executor in your will can help ensure that the probate process runs smoothly. - Create a Living Trust (Inter Vivos Trust)

A living trust, or inter vivos trust, is another effective strategy to avoid probate. A trust is set up while you are still alive, where you transfer ownership of assets to a trustee. Upon your death, these assets are no longer part of your estate and bypass probate. Advantages of a Living Trust:- Assets are managed by a trustee on behalf of your chosen beneficiaries

- Trust assets avoid probate entirely

How Willezy Can Help

At Willezy, we offer tools to create legally vetted Wills and Powers of Attorney, ensuring your estate plan is clear, enforceable, and up-to-date. With free lifetime updates, you can rest assured your documents remain relevant as your circumstances change. Click here to start.